Trade Setup for Thursday: Top 15 things to know before Opening Bell

Trade Setup for Thursday: Top 15 things to know before Opening Bell

Bears stormed the D-St in the second half of trading session on Wednesday and pushed the Nifty below its crucial support placed at its 200-day exponential moving average (DEMA) of 10,185. The charts showed the formation of a Bearish Engulfing Pattern.

A Bearish Engulfing Pattern is a chart pattern which consists of two candles in which the first candle is a short candle or a white candle and the following candle is a large black candle which engulfs the first candle.

In simple terms, the bias has now turned mildly bearish in the short term.

The 50-share index managed to wipe out gains made not just in the previous session but in the last two trading sessions.

The index, which opened at 10,274, rose marginally to 10,279 but then the bears took control of D-Street and pushed the index below 10,200. The index hit an intraday low of 10,111 before closing the day at 10,128 down 116 points or 1.14 percent.

“Volatility appears to be the flavour of the season as Nifty, which was otherwise looking somewhat strong, suddenly took U-turn to register a Bearish Engulfing pattern. It is threatening the trend reversal on the charts,” Mazhar Mohammad, Chief Strategist–Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

“However, as this selloff is primarily driven by global concerns the chances of stability in market post RBI policy outcome in next session can’t be ruled out as seldom this kind of news-driven moves last longer,” he said.

Mohammad further added that technically speaking, 10016 is a critical level to watch out for as breach of this level could lead to a retest of 9950 kinds of levels. Upsides for time being shall remain capped around 10279 levels, he added.

We have collated the top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 10,128.4 on Wednesday. According to Pivot charts, the key support level is placed at 10,066.53, followed by 10,004.67. If the index starts moving upwards, key resistance levels to watch out are 10,235.03 and 10,341.67.

Nifty Bank

The Nifty Bank index closed at 24,129.5 on Wednesday. The important Pivot level, which will act as crucial support for the index, is placed at 23,922.77, followed by 23,716.03. On the upside, key resistance levels are placed at 24,501.27, followed by 24,873.03.

Call Options data

In terms of open interest, the 10,500 call option has seen the most call writing so far at 38.89 lakh contracts. This could act as a crucial resistance level for the index in the April series.

The second-highest buildup has taken place in the 10,300 Call option, which has seen 38.20 lakh contracts getting written so far. The 10,400 Call option has accumulated 32.67 lakh contracts.

Call writing was seen at the strike price of 10,300, which added 10.28 lakh contracts, followed by 10,200, which added 8.37 lakh contracts, and 10,400, which added 8.21 lakh contracts.

Call unwinding was seen at the strike price of 9,700, which shed 24,525 contracts.

Put Options data

Maximum open interest in put options was seen at a strike price of 10,000, in which 46.86 lakh contracts been added till date. This could be a crucial resistance level for the index in April series.

The 9,800 put option comes next, having added 31.92 lakh contracts so far, and the 10,100 put option, which has now accumulated 28 lakh contracts.

During the session, put writing was seen the most at a strike price of 10,000, with 2.69 lakh contracts being added, followed by 10,100, which added 2.59 lakh contracts and 9,900 with 2.31 lakh contracts.

Put unwinding was seen at a strike price of 10,500, in which 86,400 lakh contracts were shed, followed by 10,700, which shed 65,400 contracts.

FII & DII data:

Foreign institutional investors (FIIs) bought shares worth Rs 335.18 crore, while domestic institutional investors sold shares worth Rs 152.55 crore in the Indian equity market, as per provisional data available on the NSE.

Fund flow picture:

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

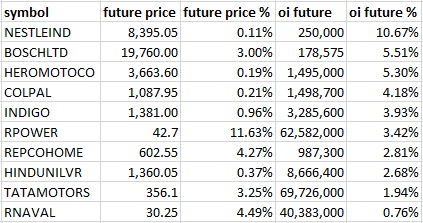

11 stocks saw long buildup

14 stocks saw short covering:

A decrease in open interest along with an increase in price mostly indicates short covering.

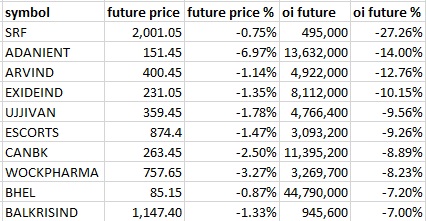

85 stocks saw short build-up:

An increase in open interest along with a decrease in price mostly indicates build-up of short positions.

100 stocks saw long unwinding

Bulk Deals:

Arcotech Limited: Vasudha Commercial Private Limited sold 5,50,000 shares at Rs 35.01 per share

Mishra Dhatu Nigam Ltd: Canara Bank sold 9,69,699 shares at Rs 89 per share and Union Bank of India sold 10,00,000 shares at Rs 90.03 per share

Sunil Hitech Engineering Ltd.: Reliance Financial Limited sold 38,87,000 shares at Rs 7.65 per share

Analyst or Board Meet/Briefings:

Siemens: Motilal Oswal Securities and Antique Stock Broking will meet the management between April 5 and 6, 2018.

MCX: Banyan Tree Advisors and Ashmore Investment Management India will meet the company on April 5 and 9, 2018.

Shriram Transport Finance: The company is meeting representatives from Elara Capital on April 5, 2018.

Indian Hotels: Eastspring met the company on April 4, 2018.

Allcargo: Quest Investment Advisors has met the management on April 4, 2018.

Stocks in news:

Adani Enterprises: The company has won an award from National Highways Authority of India (NHAI) for an infrastructure project in Chhattisgarh.

Natco Pharma: The firm has launched first generic version of oral tablets for multiple scerlosis in India.

Binani Industries: The company has offered to pay Rs 7,229 crore to lenders, creditors of Binani Cement, CNBC-TV18 reported.

BHEL: The company has begun 330 MW Kishanganga HEP In J&K.

Axis Bank: The central bank has rejected its request for gold & silver import in FY19.

Jet Airways: The airline will buy 75 Boeing 737 Max jets worth up to $9.7 billion.

No stocks under ban period on NSE

Security in ban period for the next day's trade under the F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

But for April 5, 2018 there are no stocks present in this list

Comments

Post a Comment