Rakesh Jhunjhunwala exits 2 stocks in March Qtr, some in portfolio slip up to 30% in 2018

Rakesh Jhunjhunwala exits 2 stocks in March Qtr, some in portfolio slip up to 30% in 2018

Big bull Rakesh Jhunjhunwala made an exit from Karur Vysya Bank and Orient Cement in the last concluded quarter while adding DB Realty, the debt-laden Jaiprakash Associates and Rallis India .

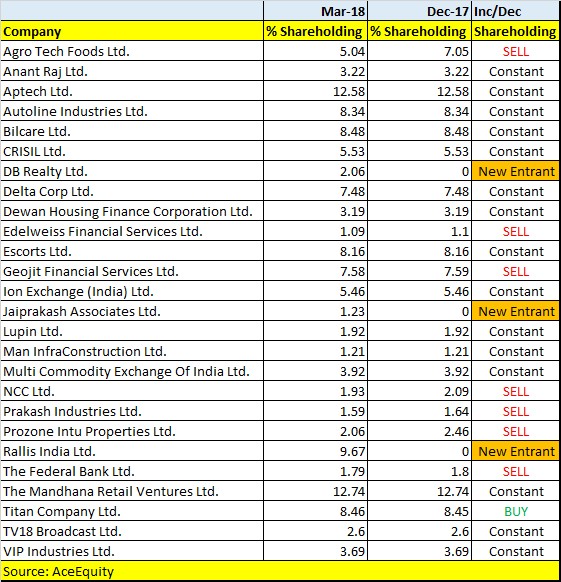

We have compiled a list of stocks from the shareholding pattern declared by companies for the quarter ended March 2018 in which Jhunjhunwala holds more than 1 per cent.

Jhunjhunwala runs a partnership firm Rare Enterprises with his wife Rekha and usually makes a purchase under following names -- Rakesh Jhunjhunwala, Jhunjhunwala Rakesh Radheshyam, Rekha Jhunjhunwala, and Jhunjhunwala Rekha Rakesh.

The 54th richest Indian, as per Forbes list of billionaires, Jhunjhunwala pared his stake marginally in seven companies such as Agro Tech Foods, Edelweiss Financial Services, Geojit Financial Services, NCC, Prakash Industries, Prozone and The Federal Bank.

The investor with a Midas touch added 0.1 stake in Titan Company in the quarter ended March. Across his various entities, the ace investor held 8.46% stake in the company at the end of March, translating to 75.10 million shares, data filed with BSE showed.

Titan Company, which ranks as the fifth highest holding in Jhunjhunwala’s portfolio, has risen a little over 11 per cent so far in 2018 but more than doubled investor wealth in the last one year.

Rakesh Jhunjhunwala has 26 stocks in his portfolio with a public shareholding of over 1 per cent, according to data compiled from AceEquity as of April 23, 2018.

He raised stake in only one company while decreased in seven during the March quarter. Jhunjhunwala maintained his stake in comparison to December quarter in as many as 15 companies.

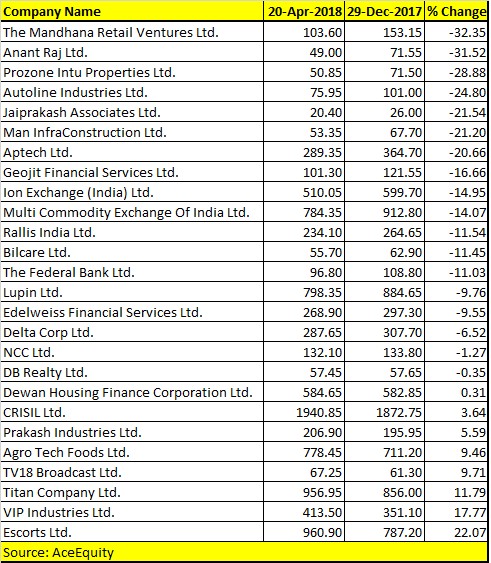

Out of 26 stocks in his portfolio for the quarter ended March, 18 stocks have given negative returns of up to 30 per cent between January 1 and April 20. The list includes names like Mandhana Retail, Anant Raj, Prozone, Autoline Industries, Jaiprakash Associates, Man Infra and Geojit Financial Services

The remaining eight gave positive returns of up to 22 per cent. These include Escorts (up 22 per cent), followed by VIP Industries (17 per cent) and Titan Company (11.79 per cent).

New Entrants:

The big bull raised his stake by over 1 percent in three companies for the quarter ended March, namely D B Realty, Jaiprakash Associates and Rallis India.

D B Realty is a Mumbai-based real estate development company and the flagship company of DB Group, established in 2006. The stock has given flat-to-negative returns so far but has risen nearly 15 per cent on a year-on-year basis.

The second stock in which Jhunjhunwala made fresh investments is the crisis-hit Jaiprakash Associates in which he re-entered after selling his entire holding in the December 2017 quarter. In his second entry, he raised his stake to 1.23 per cent in the March quarter. The stock has been a clear underperformer so far in the year 2018, down by over 20 per cent while on a 1-year basis it is up a little over 60 per cent.

The flagship company of the Jaypee group has now deposited a total of Rs. 650 crores in the registry of the Supreme Court.

And, the third stock is Rallis India. The stock has been a marked underperformer in the current year so far, down a little over 11 per cent, while on a year-on-year basis it is down nearly 7 per cent.

Rallis India, a Tata group company, is one of India's leading agrochemical marketers and is a 50% subsidiary of Tata Chemicals.

Rallis India’s third-quarter earnings missed analyst estimates due to lower-than-expected margins. The key positive takeaway from the December quarter was double-digit volume growth across both domestic and export business.

Analysts remain positive on the stock despite muted results. Domestic brokerage IIFL maintains an ‘ADD’ rating on the stock with a target price of Rs. 300.

Comments

Post a Comment